Amphenol Sets New Records in Q1 2025: Sales Surge, Profitability Soars

Amphenol Corporation, a leading global provider of electronic and interconnect solutions, has announced its record-breaking first quarter (Q1) results for 2025. The company's financial performance far exceeded expectations, with significant increases in sales, profitability, and operating cash flow.

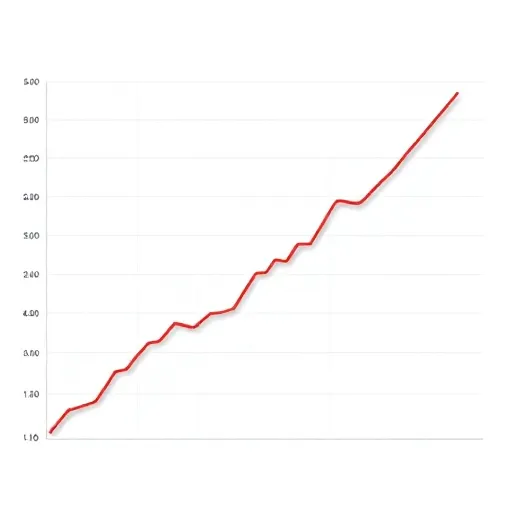

According to the Q1 2025 conference call transcript, Amphenol achieved a remarkable $4.811 billion in sales, representing a 48% increase in U.S. dollars, 49% in local currencies, and 33% organically compared to the same period last year. This impressive growth can be attributed to the company's strategic expansion into high-growth markets, including the IT datacom sector.

The Communication Solutions segment was a standout performer, with sales increasing by 91% in U.S. dollars and 73% organically. Harsh Environment Solutions also saw significant gains, with sales up 38% in U.S. dollars and 8% organically. The Interconnect and Sensor Systems segment experienced modest growth, with sales rising 5% in U.S. dollars and 6% organically.

Amphenol's GAAP operating income reached a record $1.025 billion, with an impressive 21.3% operating margin. Excluding acquisition-related costs, the company's adjusted operating income was $1.130 billion, resulting in a record adjusted operating margin of 23.5%. This remarkable improvement in profitability reflects Amphenol's ability to leverage its increased sales volumes and execute on cost-saving initiatives.

"I am very proud of the company's record operating margin performance in the first quarter," said Craig Lampo, Amphenol's CFO. "This achievement is a testament to our team's continued strong execution and commitment to delivering high-quality products and services to our customers."

Other highlights from Q1 2025 include:

- A record $5.292 billion in orders, up 58% compared to the same period last year.

- A book-to-bill ratio of 1.1:1, indicating a strong order backlog and confidence among customers.

- GAAP diluted EPS increasing by 32% to $0.58, and adjusted diluted EPS rising 58% to a record $0.63.

- $765 million in operating cash flow, representing 104% of net income, and $580 million in free cash flow, or 79% of net income.

Amphenol continues to execute on its strategy of investing in high-growth markets and driving operational excellence. The company's commitment to delivering value to shareholders is evident in its capital return initiatives, which saw a total of $380 million returned through share repurchases and dividend payments in Q1 2025.

"We are pleased with our Q1 results and remain confident in Amphenol's position as a leader in the global electronics market," said Adam Norwitt, CEO. "As we look ahead to the rest of 2025, we expect to continue delivering strong financial performance and driving growth through strategic investments."