Weyerhaeuser Logs Strong First Quarter 2025 Results, Boosted by Domestic Market Growth

Weyerhaeuser reported solid first-quarter results for 2025, with earnings of $83 million or $0.11 per diluted share on net sales of $1.8 billion. The company's adjusted EBITDA totaled $328 million, a 12% increase over the fourth quarter of 2024.

According to Devin Stockfish, Chief Executive Officer, the operational performance delivered by the company's teams is commendable, especially considering elevated macroeconomic uncertainty in the first quarter. 'I'm pleased with the results and our team's efforts,' said Stockfish during the earnings conference call.

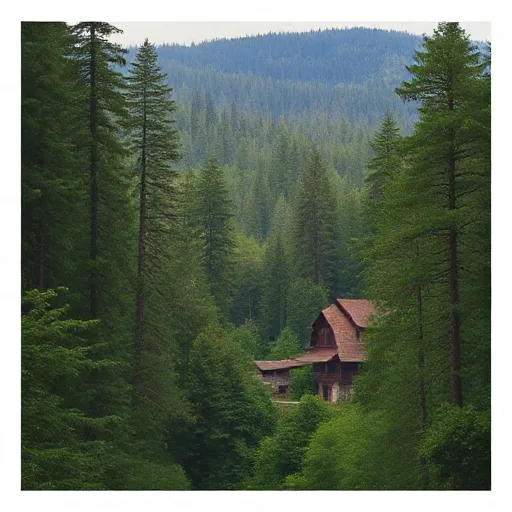

Timberlands contributed $102 million to first-quarter earnings, with adjusted EBITDA reaching $167 million, a $41 million increase compared to the fourth quarter. The growth was largely driven by stronger domestic sales realizations in the West, where log demand was healthy as mills responded to strengthening lumber prices and seasonally lower log supply.

In the Western market, log pricing for Weyerhaeuser's grade logs increased significantly, with average domestic sales realizations being higher compared to the fourth quarter. The company strategically shifted logs to domestic customers and paused shipments to China, given the recent ban on U.S. log imports. Fee harvest volumes were moderately higher, and per-unit log and haul costs decreased as Weyerhaeuser made the seasonal transition to lower elevation and lower-cost harvest operations.

Meanwhile, in Japan, demand for Weyerhaeuser's logs improved in the first quarter due to a recent decrease in shipments and inventories of imported European lumber. As a result, sales volumes for export logs to Japan were significantly higher compared to the fourth quarter, with average sales realizations slightly higher. In China, log demand moderated in response to reduced consumption during the Lunar New Year holiday.

Weyerhaeuser elected to reduce volumes into China due to this dynamic and improving Western domestic market conditions. The company paused all shipments in early March in response to Chinese regulators announcing an immediate ban on log imports from the U.S. Despite this, Weyerhaeuser's first-quarter results were not significantly impacted by the ban, and it does not anticipate a material headwind to its Western business in the near term.

The company was able to shift volumes to other buyers for its Western logs, thanks to its diverse customer base. It is worth noting that Weyerhaeuser had reduced its China export program in the quarters leading up to the log ban due to ongoing consumption headwinds in the region and improving Western domestic market conditions.

Overall, Weyerhaeuser's first-quarter results demonstrate a solid start to 2025, with growth driven by domestic market performance. The company's operational efficiency and adaptability have enabled it to navigate uncertainty and capitalize on emerging opportunities.