Compass Inc. Surpasses Industry Growth with Record-Breaking Q4 Results

Compass Inc., a leading real estate technology company, has made headlines with its impressive fourth-quarter (Q4) results for 2024. The company's financial performance has outpaced the industry, showcasing a clear advantage in market share gains, revenue growth, and adjusted EBITDA.

In a recent conference call, Robert Reffkin, Founder and CEO of Compass Inc., highlighted the company's achievements. "We continued to widen the gap between Compass and the industry as we increased revenue and adjusted EBITDA, accelerated our market share gains, grew agent count, expanded title and escrow attach rates, continued to retain agents at industry-leading levels, exceeded our OpEx targets, extended our unique inventory advantage, achieved our 2024 goal of keeping stock comp below $130 million and generated another quarter of positive free cash flow," Reffkin stated.

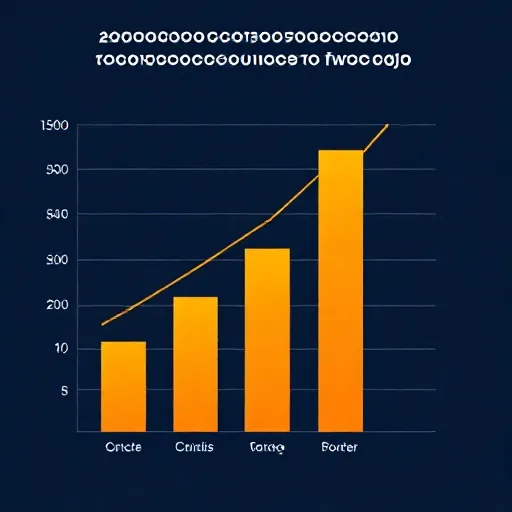

Compass Inc.'s Q4 revenue increased by a remarkable 25.9% year-over-year, outperforming the overall market's growth rate of 6.8%. The company's total transactions and organic transactions surged by 24.1% and 15.5%, respectively, compared to the industry average. This indicates that Compass Inc.'s growth was 3.5 times faster than the market in terms of total transaction count and 2.3 times faster in terms of organic transaction count.

One of the key highlights of Compass Inc.'s Q4 results is its significant expansion of market share. The company successfully recruited 669 principal agents organically, while maintaining a strong quarterly principal agent retention rate of 96.9%. For the full year 2024, Compass Inc. grew its net principal agent count by an impressive 3,069 agents or 21% compared to year-end 2023.

The company's Title and Escrow (T&E) business also saw significant growth, with a record quarter of T&E attach in Q4. Over the past four quarters, Compass Inc.'s T&E attach rate has improved by more than 800 basis points, resulting in nearly quadrupled profitability year-over-year. The company expects to drive a similar level of improvement in its T&E attach rate in 2025, which should help it double adjusted EBITDA in this business year-over-year.

Compass Inc.'s commitment to controlling organic operational expenses (OpEx) at an annual growth rate of 3-4% is another notable aspect of the company's financial performance. By sticking to its playbook, Compass Inc. believes it can generate hundreds of millions of dollars in adjusted EBITDA and free cash flow for its shareholders as the market recovers.

The company's Q4 results demonstrate its ability to execute on its strategy and maintain a strong market position. With a clear focus on growth, retention, and operational efficiency, Compass Inc. is poised to continue its success in 2025 and beyond.