Micron Technology Sees Strong Growth Ahead as Server Demand Picks Up

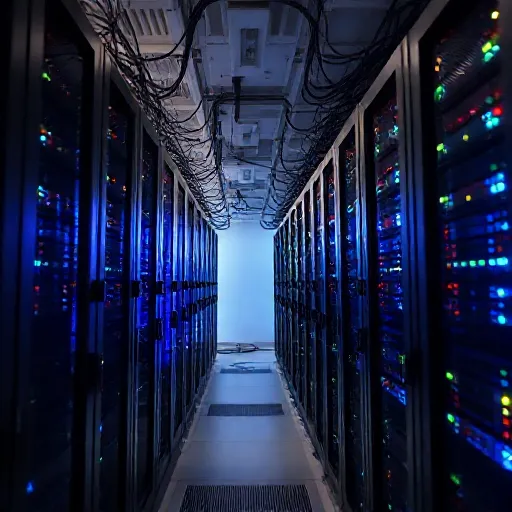

Micron Technology, a leading provider of advanced semiconductor solutions, has reported strong operational execution in its recent Q4 2024 earnings call. The company's CEO and CFO highlighted several key highlights from the quarter, including growth in server demand and improved competitive positioning in the server arena.

In an interview with investors, Satya Kumar, Investor Relations for Micron Technology, was joined by Sumit Sadana, Chief Business Officer; Manish Bhatia, EVP of Global Operations; and Mark Murphy, CFO. The discussion centered around forward-looking statements regarding market demand and supply, market trends and drivers, and the company's expected results and guidance.

One of the key highlights from the quarter was the growth in server demand, which is expected to continue into next year. Sumit Sadana noted that the traditional server market has been compressed over the last couple of years, but there will be some modest unit growth this year and next year. The growth in AI servers is also expected to be strong this year and next year, with the company seeing continued momentum in the area.

Additionally, the company highlighted its improved competitive positioning in the server arena, particularly with regards to HBM (High-Bandwidth Memory) growth in AI servers. Mark Murphy noted that high-capacity DRAM DIMMs, such as 128-gigabyte, are used in both AI servers and traditional servers, but predominantly in AI servers due to their higher cost per bit.

The company also touched on its inventory levels, which rose $300 million in the quarter. While Mark Murphy noted that Micron does not typically give dollar estimates for inventory, he did suggest that fiscal Q4 2025 may remain the peak dollar value of inventory as PC and smartphone demand begins to improve in the first half of the year.

Finally, Harlan Sur from JPMorgan asked about the impact of better-than-expected yield improvements in HBM on the company's DRAM shipment outlook. Mark Murphy noted that while the exact impact is difficult to quantify, it is likely a contributing factor to the improved outlook.

Overall, Micron Technology's Q4 2024 earnings call highlighted several key strengths and growth areas for the company, including strong operational execution, improved competitive positioning in the server arena, and continued momentum in AI servers. As the company looks ahead to fiscal 2025, investors will be watching closely for further developments.