Isn't it a Pity, Isn't it a shame?

-By Sam B | [email protected]

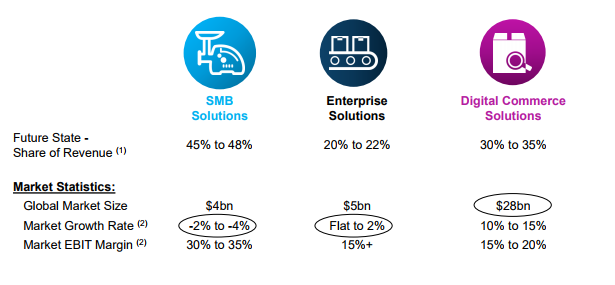

In Pitney Bowe's 2015 annual presentation to investors in December of 2015, it projected revenue growth in its 3 segments. Revenue was supposed to decline 2-4% a year in Small and Medium Business (SMB) but this quarter saw revenue decline of 8%.

Pitney Bowes (PBI), the Stamford Connecticut based company that offers global technology products and solutions, which help clients navigate shipping and mailing and cross border e-commerce, reported Q3 results on November 1st and saw its stock drop from around $14 a share to approximately $11. Revenue was flat compared to the prior year. Adjusted EPS came in at 33 cents compared to 44 cents reported last year. The CEO of the company, Marc Lautenbach, suggested that these results were as expected because many of the products that PBI is planning for its next chapter of growth “transcends” the current state of the company.

Cash flow decreased $11 million compared to the prior year to $109 M. The company reports its results in three segments. The SMB solutions segment, which offers mailing and office shipping options, saw revenue decline approximately 8% ex currency; EBIT for this segment declined 23% to $117 M. The company’s enterprise business solutions group, which includes production mail and presort service segments, saw revenue rise approximately 1% while EBIT declined 1%. The digital commerce solutions group, which includes software solutions, customer information and location intelligence software, saw revenue rise 19%. However, profitability dropped 5% in this segment. This segment has two pieces: the Software Solutions Group side of the segment increased profitability by over 100%, but the Global E-commerce group side had an operating loss (EBIT) of $10 M compared with a profit of $2M last year—however, revenue did rise 19% in the Global E-commerce group. The company said that the operating loss was attributable to investments in market growth opportunities and a resolution of a vendor contract dispute. PBI said it was lowering its guidance for EPS to $1.38 to $1.46 a share from $1.7 to $1.78.

The company announced a $200M spending reduction program over the next 2 years. It also announced the closing of Newgistics on October 2, 2017. The company is, also, now projecting free cash flow of $350 to $380 down from $400 to $430 M. The CEO stated “clearly, part of the mess is due to poor execution. “ The company had originally estimated adjusted EPS of $1.7 to $1.85 only to decrease it to $1.70 to $1.85 in Q4 and to further reduce it a few more times to the current estimate. The company continues to see persistent declined in its largest segment SMB. The company estimates that this business will continue to decline 2-4% a year as outlined in its 2015 annual investor presentation.